A bellwether for a growing industry using technology to break down the walls around real estate investing

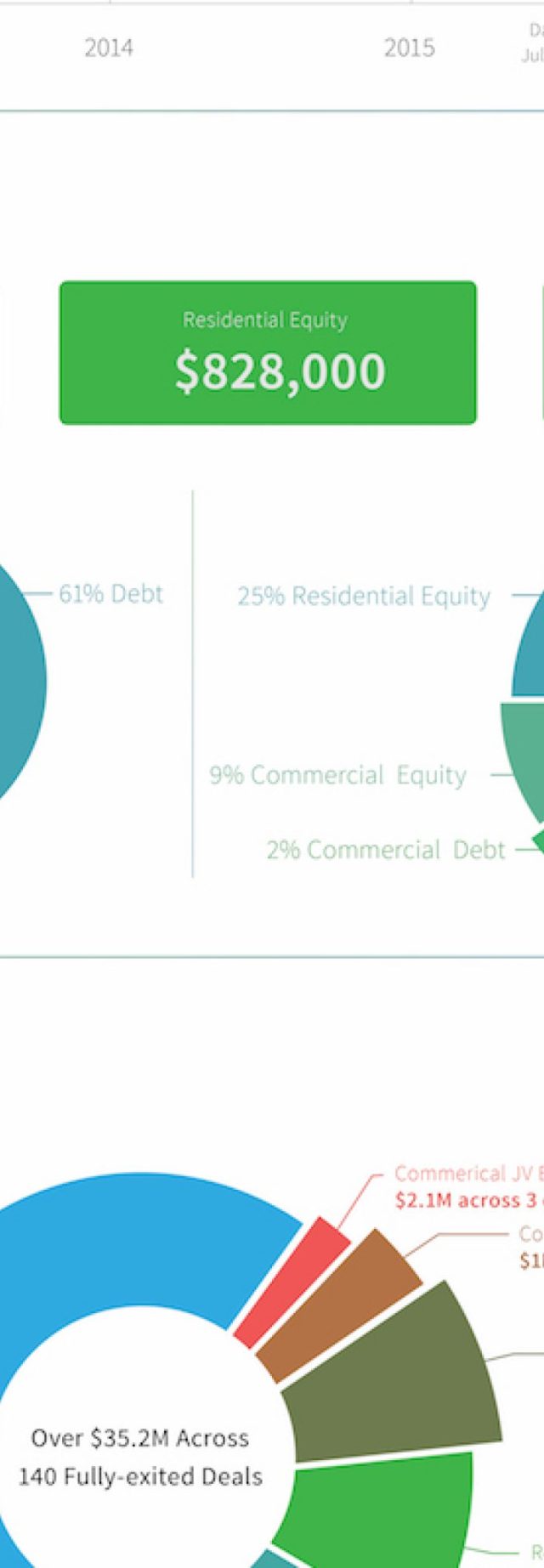

SAN FRANCISCO–RealtyShares, a leading online marketplace for real estate investing, today announced that it has raised more than $200 million in capital from its network of investors for residential and commercial real estate projects across the country.

The company connects more than 25,000 accredited and institutional investors with pre-vetted real estate companies and operators looking to raise debt or equity capital through its marketplace. This community of investors is using the RealtyShares marketplace to review and participate in opportunities for as little as $5,000.

“As a leader in the online real estate investing space, this accomplishment is not only important to the team here at RealtyShares, but also to the industry as a whole,” said Nav Athwal, founder and CEO of RealtyShares. “It is further proof that opening up real estate investing and capital formation through technology and bridging the gap between investors and operators has tremendous value.

Since its founding in 2013 in wake of the JOBS Act, RealtyShares has launched more the 400 investment opportunities on the platform, funding residential and commercial projects in 31 states. After securing a $20 million Series B fundraising round led by Union Square Ventures, Menlo Ventures and General Catalyst Partners in February, RealtyShares has accelerated efforts to build a comprehensive technology drive real estate investment marketplace. Growth soon followed. The company’s second quarter was their largest, funding $43.6 million in investments. In August, RealtyShares welcomed a record 4,500 new accredited investors to the platform.

Much of that growth comes from the company’s focus on diversification, allowing investors a single platform to invest in a variety of deals. From debt to equity, residential to commercial, RealtyShares relies on its expert team of real estate investment professionals to source and underwrite opportunities investors might otherwise not have access to.

“Online investment platforms like Real Estate are leveling the playing field for individual and institutional investors by bringing transparency and accessibility to real estate,” said Nav Athwal. “In the past, investing in real estate was a very convoluted and reclusive process. It is a multi-trillion dollar industry and most investments are still done with pen and paper and with capital requirements in the hundreds of thousands or millions of dollars. By marrying technology with changes in regulations under the JOBS Act, we have a been able to streamline the investment process, greater greater accessibility and reduce the barrier to entry substantially. This is game changing or the real estate industry and we’re excited to be at the forefront”.

In addition to this milestone, RealtyShares also recently announced that it has closed a $30 million line of credit through an institutional partner, which will allow the company to pre-fund every debt deal, as well as select equity investments, before making them available to investors through its marketplace. The credit line allows the platform to put its own balance sheet towards funding projects, bringing a new level of commitment to the investments listed on the platform and better alignment between RealtyShares and its base of accredited investors. It also provides Sponsors with more predictability around the funding of their projects, an important aspect of any real estate transaction.

For more information about the $200 million announcement, check out Founder and CEO Nav Athwal’s blog post on the RealtyShares website.